Simon Jack

Business Editor

Lucy Hooker

Business reporter

An independent commission, designed to deliver the largest review of the water sector since privatisation in the 1980s, is being set up to examine how best to tackle the tide of problems threatening to engulf the sector.

The Independent Water Commission will be chaired by former deputy governor of the Bank of England Sir Jon Cunliffe and will report by the middle of next year.

Fury has mounted in recent years over the UK’s polluted waterways and crumbling infrastructure that is struggling to cope with the challenges of a rising population and climate change.

The UK and Welsh governments said the the commission would pave the way for tougher regulation and boost investment to rebuild the UK’s “broken water infrastructure”.

Almost all options will be considered, including reforming or abolishing the current regulator, Ofwat.

However, the government has ruled out nationalisation of the sector, as too costly and slow.

Instead, the private sector will need to provide the investment needed to upgrade pipes, sewers and reservoirs. But in order to attract private capital into the sector, it is likely that customers will face higher bills.

The BBC understands that Ofwat is already preparing to allow water companies to raise bills by more than originally agreed.

In July, Ofwat provisionally said bills would rise by an average of £19 per year between 2025 and 2030 – totalling a £94 increase, or a 21% rise, over that five year period.

It is unclear by how much more bills will rise instead, but the watchdog will make its final decision at the end of the year.

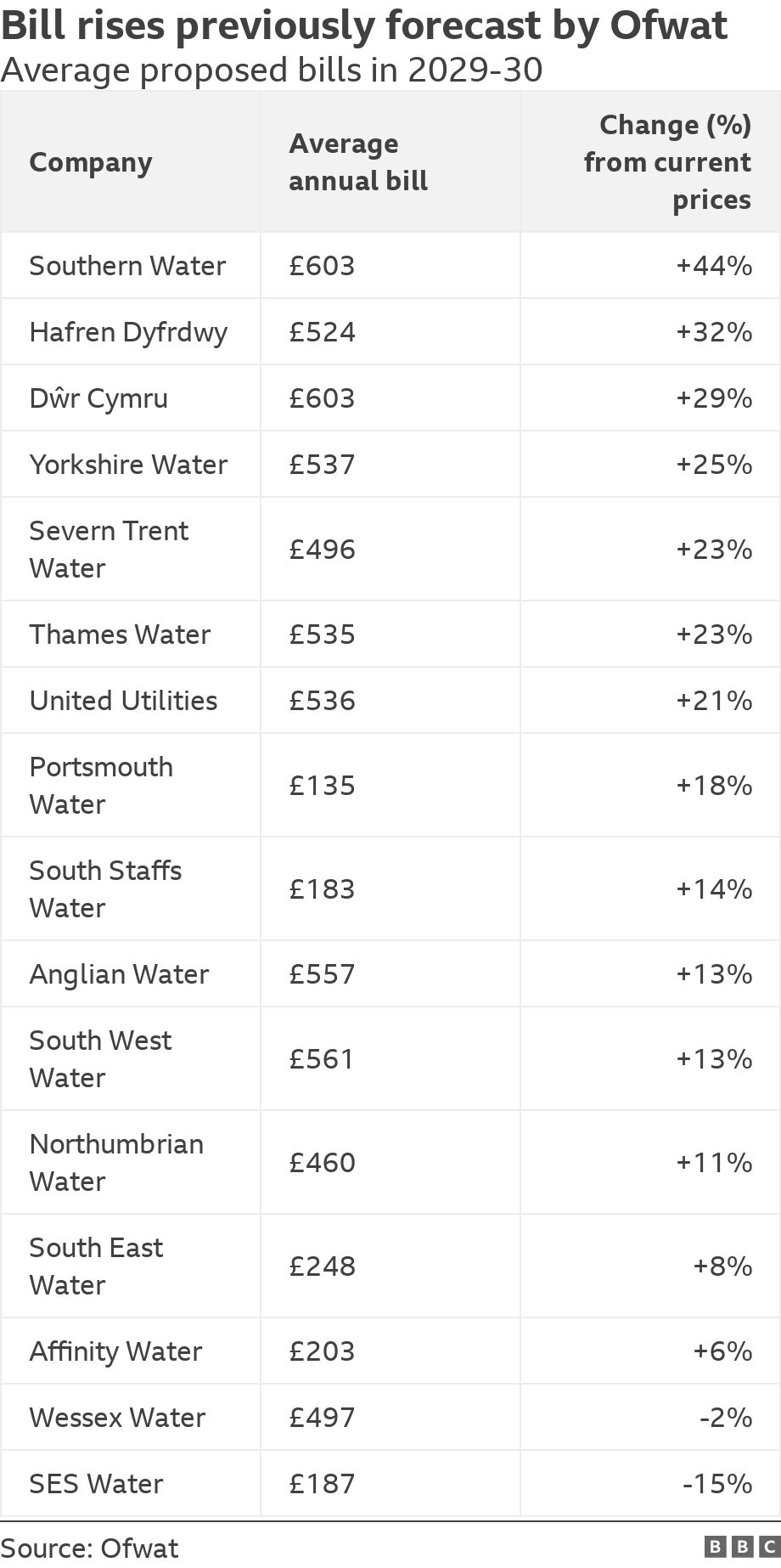

While the entire sector is facing challenges, the increases previously proposed by Ofwat in July , externalvaried greatly from company to company.

The highest agreed rise of 44%, was for Southern Water, and the lowest was a bump of 6% for Affinity Water.

Bill rises previously forecast by Ofwat

Average proposed bills in 2029-30

| Company | Average annual bill | Change (%) from current prices |

|---|---|---|

| Southern Water | £603 | +44% |

| Hafren Dyfrdwy | £524 | +32% |

| Dŵr Cymru | £603 | +29% |

| Yorkshire Water | £537 | +25% |

| Severn Trent Water | £496 | +23% |

| Thames Water | £535 | +23% |

| United Utilities | £536 | +21% |

| Portsmouth Water | £135 | +18% |

| South Staffs Water | £183 | +14% |

| Anglian Water | £557 | +13% |

| South West Water | £561 | +13% |

| Northumbrian Water | £460 | +11% |

| South East Water | £248 | +8% |

| Affinity Water | £203 | +6% |

| Wessex Water | £497 | -2% |

| SES Water | £187 | -15% |

Source: Ofwat

In July Thames Water, the UK’s largest water company, was given the go-ahead to lift bills by 23%. It has since said it needs to raise bills by 59%, in order to keep operating as normal.

Thames Water shareholders refused to inject promised funds into the company earlier this year as they said it would be impossible to make any profit at proposed bill levels.

One of the reasons that Ofwat is considering permitting bigger bill increases is to reflect higher financing costs, the BBC understands.

The commission will seek to address these competing demands by taking input from a wide pool of stakeholders including customers, environmental bodies, investors and engineers whose interests are not always aligned.

Environment Secretary Steve Reed, said the commission’s findings would “help shape new legislation to reform the water sector so it properly serves the interests of customers and the environment”.

Sir Jon said his previous experience working for the public sector, the Treasury and at the Bank of England had had shown him that “the regulation of private firms can be fundamental to incentivising performance and innovation, securing resilience and delivering public policy objectives”.

Image source, Getty Images

Sir Jon Cunliffe, former deputy governor at the Bank of England, will chair the commission

‘Doom loop’

Customers have been furious at the scale of spills and pollution while investors have claimed the bills they have been allowed to charge are insufficient to attract the investment needed to fix the problems.

Some companies have been caught in what one executive described as a “doom loop” – with underperforming companies fined for sewage discharge and leaks leaving them with even less money to fix the very problems they have been fined for.

Investors have also been condemned for the dividends and executive pay they have paid out while pollution and leaks have risen.

In short, no-one is happy with the current set up.

Ofwat, which has been criticised for its track record in regulating the industry, welcomed the plans for the new commission.

“We are ready to back record investment, the challenge for water companies is to match that investment with the changes in company culture and performance that are essential to rebuilding the trust of customers and the public,” Ofwat chief executive David Black said.

Campaigners also welcomed the move. River Action said the commission should “deliver a fully funded national action plan to end pollution for profit, enforce laws, and reform regulators”.

However, Matthew Topham at We Own It said the “root cause” of the problem was privatisation and described the strategy as the “re-privatisation” of the water industry.

Get in touch

Are you affected by the issues raised in this story?